Once upon a time there was a vessel called Süderoog. Retold, in case you forgot already

She was virtually shiny and new,

having been delivered from the shipyard in December 2005.

Things were going very well for the

Süderoog until the global financial crisis started to make it's effects felt in

the chartering markets, and by the end of 2008 it was virtually

impossible to find her any employment,. The brave people working for her

Owners (Briese Schiffahrts & Co KG MS Süderoog in Leer, Germany)

and BBC Chartering & Logistic (also of Leer, Germany) tried

all they could to get the vessel employed, but to no avail. So finally,

regretfully, the only economical solution was for the vessel to be laid up.

Thus it was that during December of

that year most of the crew of MS Süderoog were disembarked and the vessel was

laid up. Only two crew members were left on board to look after her while

she went into an enforced hibernation. Moored at the quayside, unladen,

waiting......it's impressive cranes dormant,.

And so her plight continued, all

the way through 2009.

These sad messages reflect our

vessel's plight :

Of the usual nine ratings on board

only two were there from January until July, then only an able-seaman/cook

until the year end. The time must have dragged interminably for this one

poor soul.

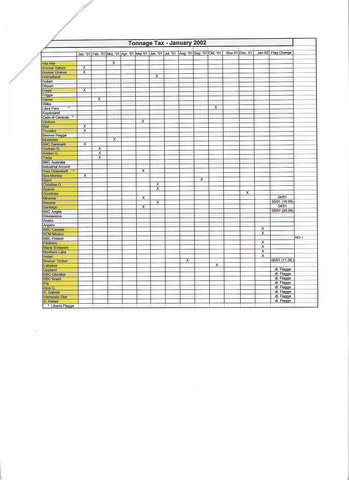

Here is a worksheet showing the

actual crew variances for the year :

"Not, much of a story!",

do I hear you say? Perhaps, but in September strange things had started

to happen. Not on board the ship, but on dry land.

A message was sent on the 21st

September from Briese's internal crewing department, then 'Leda Shipping GmbH'

asking an offshore 'umbrella' management company in Monaco to issue invoices in

the name of the offshore corporation (ITCC) used for invoicing the provision of

ratings to the owners for a full compliment of officers being on board the ship

for the first six months of the year

So there had been Officers on

board? Where had they come from? Why was ITCC charging for them

when they normally only supplied ratings? Had ITCC also paid their wages?

Where had the vessel been to if it had had a full crew on board? There

must have been crew lists for the port of call records, agents disbursement

accounts for theses calls bunkers and supplies bought, air tickets

arranged and paid for, and a whole lot more.. Were we faced with

a 'phantom crew'? Had the 'Süderoog' been making phantom voyages upon the

high seas all this time instead of languishing in some forgotten corner of a

port as we all had been led to believe? Had the vessel been under a highly

sensitive military charter?

More intrigue was to come...... it seemed the story was not closed, a

request was received for an in-house travel agent to reissue invoices for

flights to another vessel to the 'Süderoog' instead !!! And on

December 28th a definitive message seemed to explain all

:...........................

and this was the attachment:

This was pretty serious stuff.............................and it continued over

the next two days

28th December

29th December

Finally culminating with:

Hellor,

@@ asked me to get back to you in

this matter. Indeed some of the previously issued invoices/credit notes are not

required anymore. Here is how the figures will officially enter into

our books:

(1) Lumpsum USD 24.100,00

01.01.2009 - 05.07.2009

=>

invoices 19667,19909,20200,20473,20712,20913,21118 credit note 22587

(2) Lumpsum USD 6.600,00

06.07.2009 - 31.12.2009

=>

invoices 22588-22593

(3) wages paid by ITCC on

behalf of Süderoog

=> invoices

19708,19947,20238,20510,20749,20950,21153

Invoices/CN not needed (as

you mentioned below): CN 21254, 22581-22586 Inv. 19643,19885,20176,20449,20691,20892

Which you can see

here.................

This is only the crewing of the vessel for half a year...............Can you

imaging what might be needed for the Charterer's accounts, Agents Disbursement

Accounts, Bank Statements (!!!! ????) Bunkers, Lubes, Travel and

Transport,